War in Ukraine, Inflation and Labor Among the Factors Complicating a “Return to Normal”

A new survey of supply chain executives by Carl Marks Advisors, in partnership with SupplyChainBrain, underscores the deep and lasting impact of COVID-related supply chain disruptions.

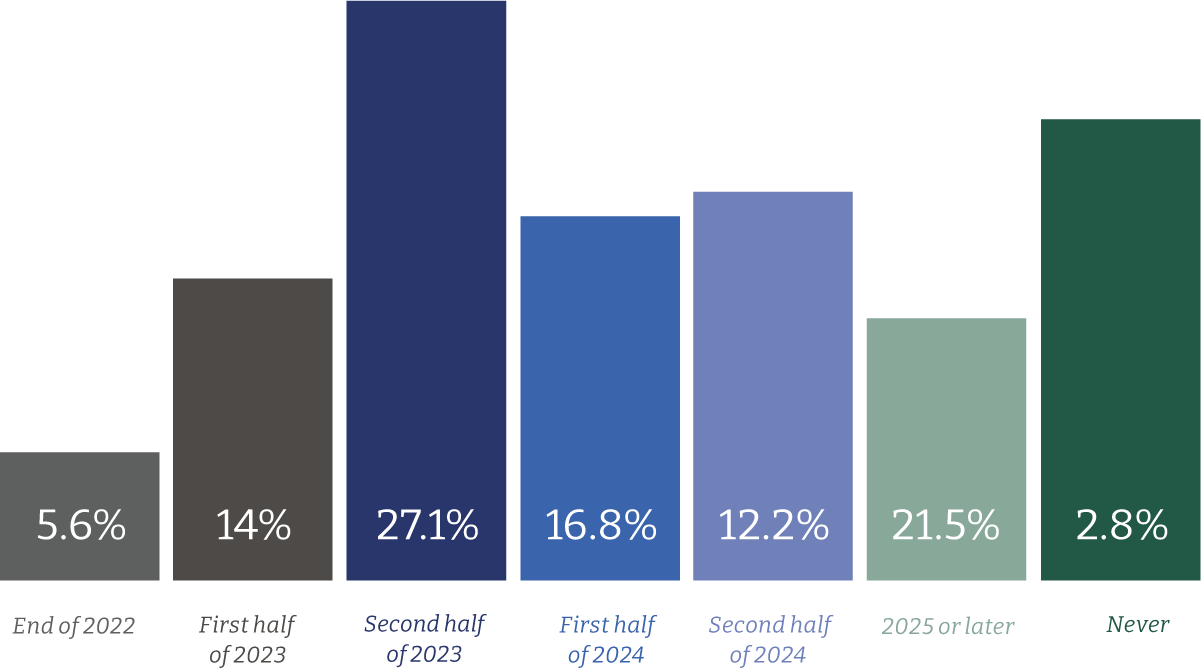

According to the research, more than half of all respondents don’t expect a return to a more normal supply chain until the first half of 2024 or beyond, and while another 22% say they expect disruptions to continue until the second half of 2023. They also see a number of threats clouding the picture and complicating a return of a more reliable supply chain, most notably the war in Ukraine (30%) and labor concerns (24%).

When the U.S. Can Expect a "Return to Normal"

This research underscores just how profoundly the pandemic impacted corporate supply chains, but also how economic conditions, rising inflation and global tensions are preventing a return to normal.

Peter Keogh

Managing Director, Carl Marks Advisors

A Return to Normal Isn’t Imminent

Looking forward, more than two-thirds of supply chain executives said they are “very concerned” that the U.S. economy could tilt into a recession over the next 12 months as a result of rising interest rates, high inflation and geopolitical uncertainty, and a resultant pull-back in consumer confidence. When asked what “magic levers” could potentially bring supply chain costs under control in 2022 and help mitigate uncertainty, ending the war in Ukraine (32%) and lowering fuel costs by 20 percent (31%) were the leading responses.

According to the survey, 75% of supply chain executives said revenues at their company had been either negatively or very negatively impacted over the past year by supply chain issues. Ocean shipping was by far the leading broken transportation and logistics link, at 68%. The impact of the disruptions has been severe: 80% of respondents said their supply chain costs have risen by between 20-60% between December 2020 and December of 2022.

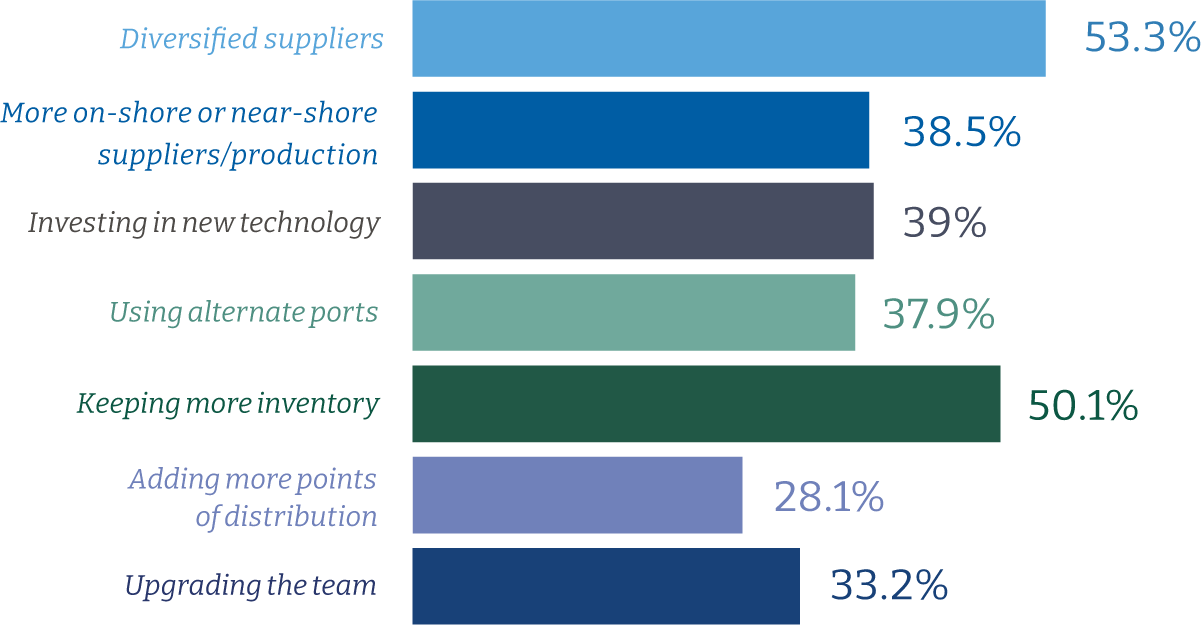

While supply chain executives have implemented a number of changes to mitigate the impact of disruptions – including keeping more inventory (30%), diversifying suppliers (27%) and using alternate ports (14%) – they have struggled to manage the cost of these new initiatives, with 55% of respondents saying their organizations have been forced to absorb more than a quarter of their supply chain cost increases.

Changes to Supply Chain Management

In this environment, it will be incumbent on organizations to review their sales forecasting, continue to monitor their on-hand inventory levels, and revisit their procurement strategies.

About the Survey

Carl Marks Advisors partnered with SupplyChainBrain to conduct the online supply chain industry survey from May 20 – June 10, 2022. In total, 107 responses were collected from the world’s most influential U.S. supply chain executives, across a variety of industry sectors.