In the News

- Press Release: Carl Marks Advisors’ survey on U.S. middle market lending reveals growing concern about borrower leverage

- Reuters: U.S. mid-market lenders concerned about leverage, loan docs: report

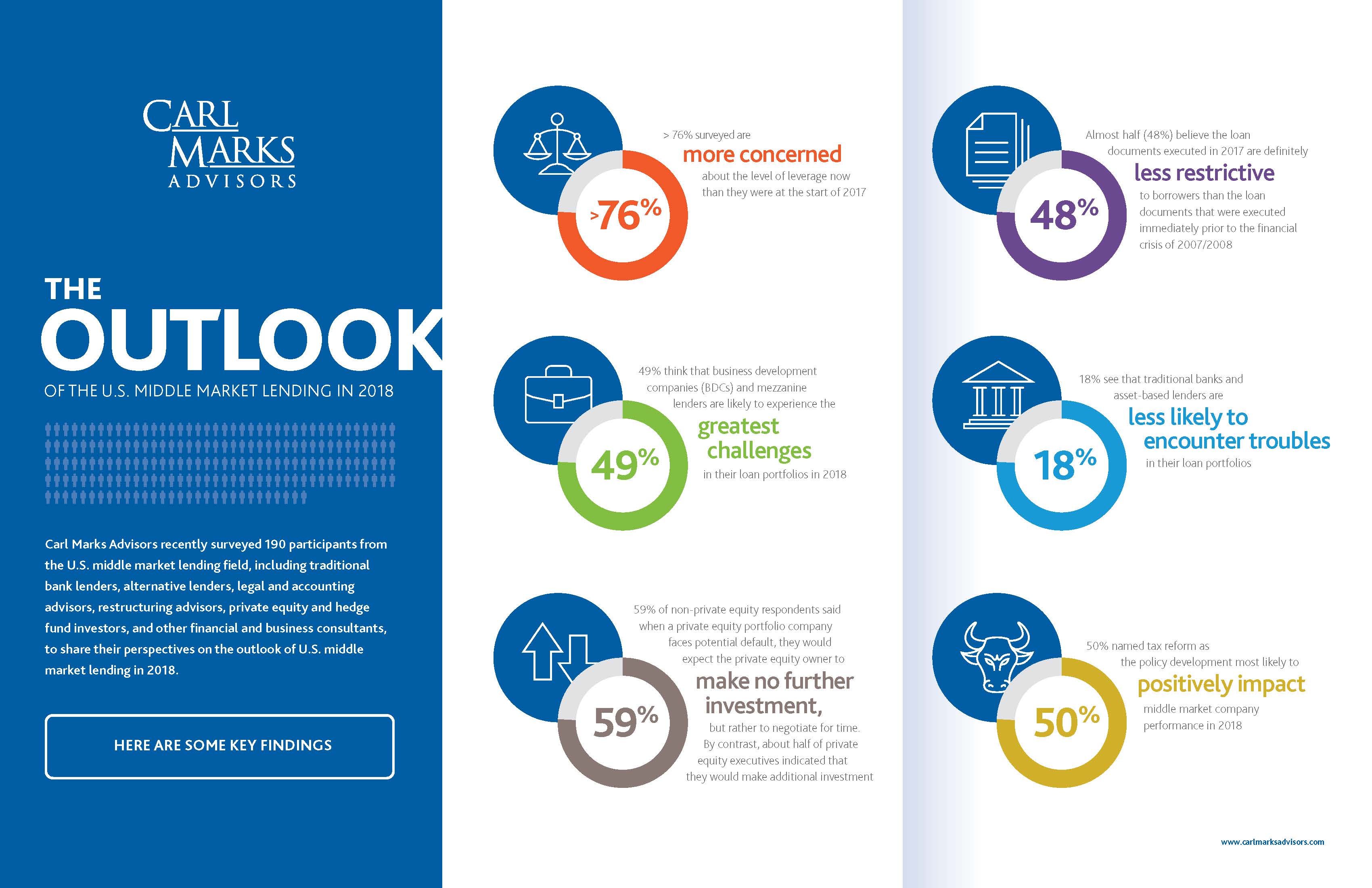

In December 2017, we surveyed 190 middle-market professionals from lending-related fields for their outlook for the lending market in 2018. Here are the results:

- 76 percent of respondents are more concerned now than they were at the start of 2017 about the level of leverage at U.S. middle market companies.

- The majority of respondents (48 percent) felt that loan documents were less restrictive to borrowers in 2017 than immediately prior to the global financial crisis. Loan document concessions that present the greatest concern for lenders are covenant-lite or springing covenants with lower triggers and the allowance of add backs to EBITDA calculations.

- 59 percent of all non-private equity/hedge fund respondents said they expect these firms to make no further investments in portfolio companies facing default, or near-default, situations. Conversely, roughly half of private equity/hedge fund respondents indicate their firms would further support these companies with additional investments.

- Respondents believe macroeconomic and geopolitical issues pose the greatest downside risk for leveraged loan portfolios in 2018.

If you’d like to learn more or receive a full breakdown of the survey results, please email jkrattiger@carlmarks.com